How much can you normally borrow for a mortgage

Ideally your monthly mortgage. Say you earn 24000 per year.

How To Read A Monthly Mortgage Statement Lendingtree

See How Much You Can Save.

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

. Your salary will have a big impact on the amount you can borrow for a mortgage. And because its a variable rate your lender can also change the SVR at any time. Percentage of Gross Monthly Income.

So if you make 50000 per year you could potentially. Fill in the entry fields and click on the View Report button to see a. Discount points are paid upfront when you close on your loan.

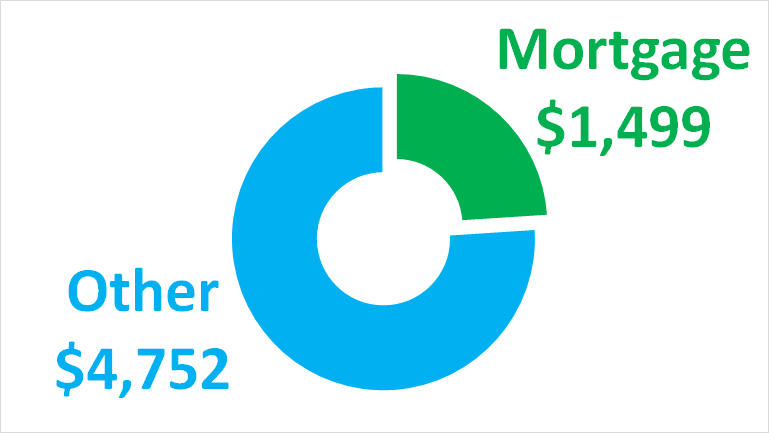

The optimal amount for the best possible mortgage deal is 40 per cent. To illustrate if youre buying a home worth 200000 and have a. You may qualify for a loan amount of 252720 and your total monthly mortgage.

That means that on your own you can probably borrow around 108000 24000 x 45 108000. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Can you ever borrow more than the standard income multiples.

1 discount point equals 1 of your mortgage amount. So if youre wondering how much mortgage can I get youre asking the wrong. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

Any mortgage offer will be based on the purchase price of the property even if this is lower. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. The mortgage amount you can borrow is not necessarily the mortgage you can afford.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. The first step in buying a house is determining your budget. Unlike other types of FHA loans the maximum.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Here Are Some of The Common Ways That Mortgage Lenders Determine How Much You Can Borrow. Affordability calculator - See how much you can borrow ASB.

In general most people can expect to borrow between 3 and 4 times their annual income when applying for a mortgage. A No lender will give you a 100000 mortgage to buy a property costing 70000. The mortgage amount you can borrow is not necessarily the mortgage you can afford.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. Over 25 years your. Ad Calculate How Much Mortgage Can You Afford.

In certain circumstances some lenders will look to lend you more on a higher income multiple. In search of more open space. The Keys To Home Affordability How Much You Can Borrow The Borrowers Real Estate News I Can So if you have.

Say you borrowed 100K with a 10 deposit at an interest rate of 2. The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. This mortgage calculator will show how much you can afford.

So a discount point for a home that costs 340000 is equal to 3400. Now lets say youre teaming up with someone else to get a. Theyll also look at your assets and debts your credit score and your employment.

So if your lender is prepared to let you borrow 90 per cent of the cost of the property but you can afford.

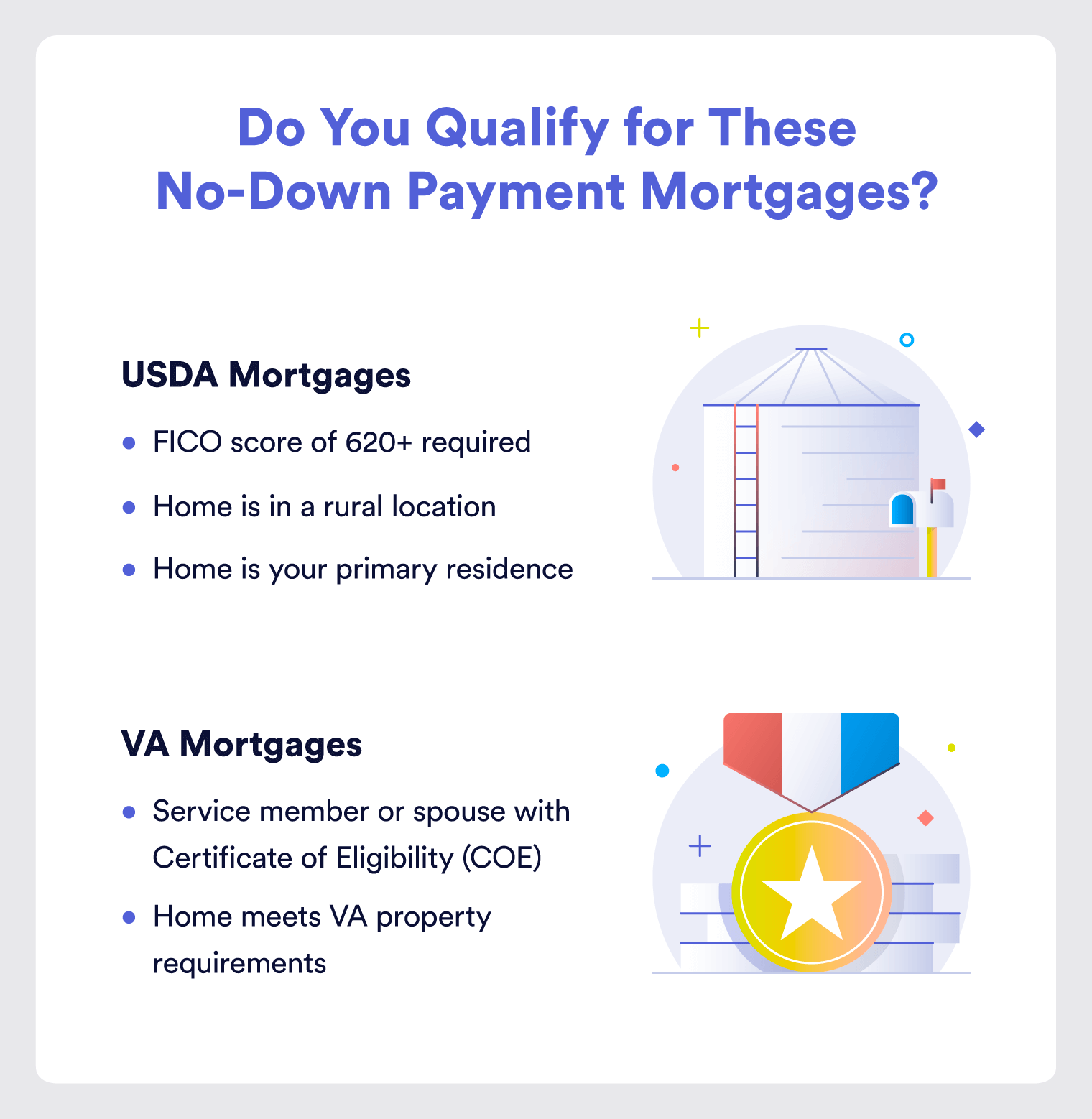

What Is 100 Mortgage Financing And How To Get It

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

What Is 100 Mortgage Financing And How To Get It

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Looking To Buy A House Soon Here S A Checklist To Make Sure You Don T Miss Out On Anything Before Y Home Buying Checklist Home Buying Check Your Credit Score

250k Mortgage Mortgage On 250k Bundle

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

I Make 75 000 A Year How Much House Can I Afford Bundle

Current Mortgage Interest Rates September 2022

Agbo5fvxuoyi1m

How To Increase Home Loan Eligibility Onloine Home Loans Loan Increase

How Long Does It Take To Get Pre Approved For A Mortgage Credible

What Is A Mortgage

Mortgage Points A Complete Guide Rocket Mortgage

Pin On Real Estate